Key Takeaways

- Staking with Coinbase is bad for the Cosmos network

- Staking with Coinbase carries extra risk

- Staking with Coinbase is expensive

- Centralized exchanges are not in the business of running validator nodes and often miss network upgrades

Why You Should Not Stake with Coinbase

Staking your idle cryptocurrency can be an excellent strategy for building wealth. Yields are generally attractive and those who actively compound their rewards can accumulate tokens quickly.

One of the worst places you can stake your crypto tokens is with a centralized exchange, like Coinbase.

Is it convenient? You bet. Is it smart? Not at all and in this article we will tell you why.

Staking Cosmos ATOM on Coinbase is bad for the Cosmos network

Staking ATOM tokens with Coinbase is bad for the Cosmos network and here’s why:

Staking with Coinbase causes centralization of voting power

Why should you care? Centralization of voting power is a problem for several reasons:

1. Security and Decentralization: One of the key benefits of blockchain technology is its ability to provide decentralization and security through a distributed network of participants.

When voting power becomes concentrated in the hands of a few entities, the network becomes more susceptible to attacks, censorship, and manipulation by those entities.

If the network gets hacked, censored, or manipulated, the underlying token plummets in value. If you care about the value of your ATOM tokens, this is an issue to be concerned about.

What if Coinbase’s validators get hacked and a bad actor takes control of all those tokens? They could take the network down on purpose, or double sign blocks to steal funds.

2. Influence over Consensus: In Proof of Stake systems, validators have the power to determine the consensus rules and validate transactions.

If a small group controls the majority of the voting power, they could potentially collude to manipulate consensus decisions in their favor, compromising the integrity of the network.

3. Economic Inequality: If a small number of entities control a large portion of the voting power, they create most of the blocks and earn the largest rewards. That exacerbates the problem because the largest validators get even bigger. It causes inequality within the consensus process and the ecosystem.

Large validators can push small validators out and it is the small validators that keep networks strong, healthy, and decentralized.

4. Centralized Decision-Making: Centralization of voting power can allow a few powerful entities to have a disproportionate say in the development and governance of the blockchain. This can hinder innovation and prevent the network from adapting to changing circumstances and user needs.

This concentration of power can lead to a situation where the interests of a few stakeholders are prioritized over those of the broader community.

Fortunately, Coinbase has not yet tried to control the outcome of Cosmo’s governance proposals. It makes sense for them to step aside and allow the community to decide what’s best for the network without taking a position.

However, part of a validator’s duty is to vote on network proposals. Not voting means their delegators don’t get a say and some proposals are extremely important. We pay attention to what is going on and vote, so our delegators don’t have to.

Staking with Coinbase carries extra risk

Staking crypto with centralized exchanges, like Coinbase offers serious convenience, but there are risks to consider:

1. Counterparty Risk: When you stake your crypto on a centralized exchange, you essentially trust the exchange to properly manage and secure your funds. If the exchange gets hacked or goes bankrupt, you may lose access to your assets.

Being publicly held, Coinbase is subject to rigorous regulation and reporting. However, there were 374 U.S. corporate bankruptcies in 2022 and 324 as of June 2023.

Also, never forget FTX.

2. Custodial Control: When you stake on a centralized exchange, you’re using a custodial service. You don’t have direct control over your private keys, which goes against the principle of “not your keys, not your coins.”

If the exchange experiences technical issues, maintenance, or downtime, it could affect your ability to interact with your assets, including staking, unstaking, or claiming rewards.

Here’s a Reddit post where an ATOM staker had trouble getting his funds back from Coinbase. 30 days after unstaking he still didn’t have access to his ATOM tokens. Posts like this are not uncommon. We’ve seen Binance close withdrawals on customers multiple times. At Blocks United we believe in self-custody.

3. Regulatory Risks: Regulatory uncertainty or changes could impact the ability of exchanges to offer staking services. This could potentially lead to freezing or loss of your staked assets.

2023 has been an active year for the SEC. They are attempting to label the most popular tokens as securities. If they are successful, not having control of your staked assets could mean losing access to them.

4. Privacy Concerns: Centralized exchanges, like Coinbase, require users to go through identity verification processes. The anonymity of crypto does not apply to Coinbase customers. Anyone who has an account with Coinbase is advised to pay their taxes. The IRS knows you’re a crypto investor.

Additionally, depending on the exchange’s data security practices, your personal information could be at risk of being exposed.

Staking with Coinbase is expensive

Staking with Coinbase sure is convenient, but it’s expensive and will eat into your returns.

1. Limited Rewards: Some centralized exchanges might not distribute staking rewards in a way that’s as favorable as other staking options. They might take a larger portion of the rewards, leaving you with less than you would earn by staking on your own or using other platforms.

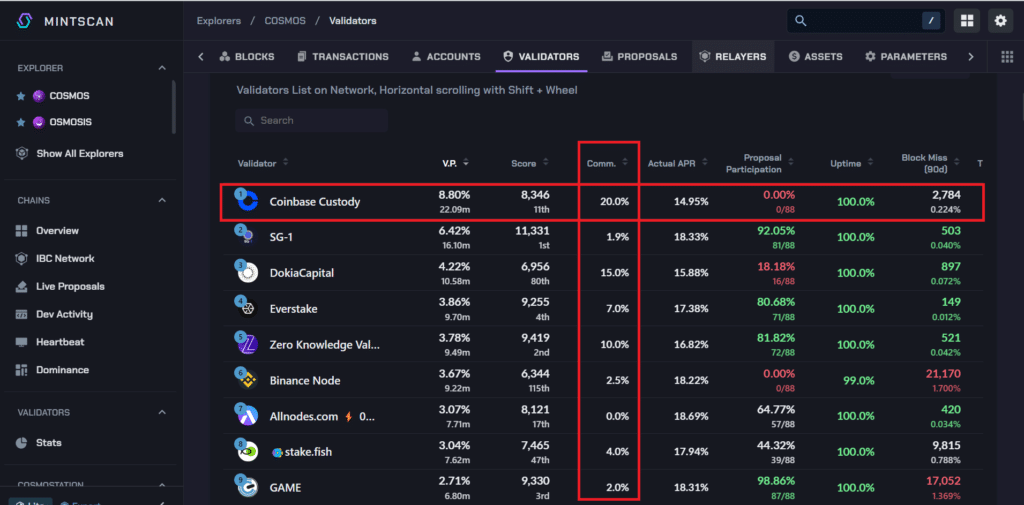

The screenshot below is from August 18, 2023, and the on-chain staking APY is 18.69%.

You will see that Coinbase currently charges a 20% commission on staking rewards, resulting in an APY of 14.95%. That’s for people who choose to stake with the Coinbase validator from a non-custodial wallet.

2. Hidden Fees: Coinbase charges hidden fees in the form of higher commissions for staking through their platform. These fees majorly eat into your staking rewards and reduce your overall returns.

If you stake directly from your Coinbase account it’s even more expensive than staking from a non-custodial wallet. The current advertised Coinbase ATOM staking APY is only 10.3%. For those who don’t want to do the math, that’s a 55% commission!

If you stake ATOM with us at Blocks United, you get a higher APY, eliminate counterparty risk, and help the network by spreading out the bonded tokens.

There are risks to self-custody that must be considered though, so check out our articles on self-custody, decentralization, our ATOM staking tutorial, and how to auto-compound your ATOM staking rewards to learn more.

3. Limited Flexibility: Centralized exchanges might not offer the flexibility to customize your staking strategy. For example, you must unstake your position to claim rewards. That affects your ability to compound returns.

Additionally, you cannot choose validators and delegate to specific nodes. You are forced to use the Coinbase validator and we’ve already covered why that is bad for Cosmos.

4. Coinbase stakers are disqualified from receiving airdrops: One of the coolest things about staking ATOM is the airdropped tokens. When new protocols launch within the Cosmos ecosystem they usually give tokens away to ATOM stakers.

These free airdropped tokens can then be staked to generate additional passive income.

Centralized exchange validators are always excluded. That’s so people are incentivized to stake with smaller, noncustodial validators because that’s what is best for the network.

Want to be notified when there are Cosmos ecosystem airdrops to claim? Sign up for our Cosmos Airdrops newsletter. As a bonus, you'll receive our wealth building series sent straight to your inbox!

Staking with Coinbase empowers a centralized institution that is not set up to run validators

Coinbase is an exchange first and everything else second.

They attempt to run validator nodes because they are motivated by profit, but often go down when there are upgrades to the network. Binance is one of the worst at this and wind up halting ATOM deposits and withdrawals for days.

The Coss team ran a test on December 1, 2023 that revealed weakness in the Hub. Every single validator missed blocks, but the centralized exchanges were some of the worst performers.

The following day they were still offline. Coinbase, Binance, and Kraken users could not send or receive ATOM. They were also not being paid staking rewards.

Conclusion

Staking from your Coinbase account is super convenient and offers full liquidity. You can unstake your ATOM tokens and get them back at any time, without waiting the traditional 21 days.

However, staking with these centralized exchanges carries extra risks to consider, is terrible for the Cosmos network, staking yield is much lower because of their high fees, and their delegators are disqualified from receiving Cosmos airdrops.

If you are comfortable with self-custody, we would love to have you as a staking partner.

Check out our ATOM staking tutorial, or click the button below to stake your ATOM with us now using Keplr wallet.

You can automatically compound your ATOM rewards using Yieldmos.

That all depends on your time horizon, investment objectives, and risk tolerance. Staking ATOM on Coinbase yields far less than staking ATOM from a non-custodial wallet, like Ledger.

ATOM staking locks your tokens onto the network for 21 days. If you may need to sell your tokens or access your funds in the short-term, do not stake them. Staking is meant for medium to long-term funds.

Additionally, staking on Coinbase is a decent option for those who are risk-averse and scared to self-custody their tokens. However, Coinbase currently charges 55% commission, which must be considered.

As of August 19, 2023, Coinbase charges 55% commission to stake ATOM directly from your Coinbase account, and 20% commission staking with their validator from a non-custodial wallet.

At Blocks United we charge a super reasonable 5% commission.

Staking rewards accrue after each block, which is about every 2 seconds.

Coinbase staking rewards can only be claimed by unstaking your assets. That is one of the disadvantages of staking through your Coinbase account.

Whereas staking from a non-custodial wallet allows you to claim, restake, and compound your rewards as often as you like. In general, the more often compounding occurs, the quicker you build your stack of tokens.

That totally depends on the token you are staking, the inflation rate, network activity that generates fees, what Coinbase is currently charging for commission, how often you claim rewards and restake them to compound, etc.

As of August 19, 2023 the ATOM staking APY on Coinbase is 10.3%, which is substantially less than APY staking from a non-custodial wallet.

No. Coinbase is fighting the SEC and still offers staking to its customers.

Coinbase offers “earn” incentives for watching short videos and then answering quiz questions. It’s a neat way to learn and get a little crypto in the process.

Yes. If the Coinbase validator is slashed for being offline all their delegators lose 0.01% of their tokens. If Coinbase double signs a block their delegators will lose 5% of their tokens. These slashing penalties apply to all validators and delegators.

Additionally, there is counterparty risk. If Coinbase goes insolvent it is likely that people who stake directly from their Coinbase accounts would lose access to their funds.

Coinbase is a reputable and regulated corporation, but customer assets are not insured. If Coinbase is hacked, customer funds are at risk of being stolen.

Other risks to be aware of include:

- counterparty risk

- custodial risk

- regulatory risk

- privacy concerns

- risk of centralizing block production and governance for the Cosmos ecosystem

Yes. That is one of the major risks to consider when allowing a centralized exchange to have custody of your assets. All centralized exchanges are under constant attack from black-hat hackers, Russian and African mafia, and governments like North Korea.

Coinbase’s security practices are of paramount importance and it is important to point out that no funds have ever been stolen due to Coinbase’s negligence.

Additionally, it is up to you to keep your account and password secure. If your digital hygiene is sloppy and you reuse passwords and don’t use 2FA, your assets are at risk.

Coinbase controls the private key, not you. That is one of the main risks of allowing a centralized party to have custody of your assets.

Remember the crypto axiom, “Not your keys, not your coins.” If not self-custody, then why crypto?

No, you must unstake your crypto to sell it. However, one of the main benefits of staking with Coinbase is that your staked funds can be unbonded at any time. They are fully liquid. You would not have to wait 21 days, like with non-custodial ATOM staking.

There are several ATOM staking calculators online, but many are inaccurate. The best one we know of is AtomScan.

Nothing we say is financial advice or a recommendation to buy or sell anything. Cryptocurrency is a highly speculative asset class. Staking crypto tokens carries additional risks, including but not limited to smart-contract exploitation, poor validator performance or slashing, token price volatility, loss or theft, lockup periods, and illiquidity. Past performance is not indicative of future results. Never invest more than you can afford to lose. Additionally, the information contained in our articles, social media posts, emails, and on our website is not intended as, and shall not be understood or construed as financial advice. We are not attorneys, accountants, or financial advisors, nor are we holding ourselves out to be. The information contained in our articles, social media posts, emails, and on our website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in our articles, social media posts, emails, and the resources on our website are accurate and provide valuable information. Regardless of anything to the contrary, nothing available in our articles, social media posts, website, or emails should be understood as a recommendation to buy or sell anything and make any investment or financial decisions without consulting with a financial professional to address your particular situation. Blocks United expressly recommends that you seek advice from a professional. Neither Blocks United nor any of its employees or owners shall be held liable or responsible for any errors or omissions in our articles, in our social media posts, in our emails, or on our website, or for any damage or financial losses you may suffer. The decisions you make belong to you and you only, so always Do Your Own Research.