Let’s get down to business. We assume you already know what staking is and the potential risks and rewards. But if not (or you need a refresher), please check out our article series: Grow Your Wealth Through Crypto Staking, and our ATOM staking tutorial.

You can auto-compound your ATOM staking rewards using Yieldmos.

Staking ATOM is a great way to earn passive income with tokens you already hold. But staking comes with risks. Choosing the right wallet and validator is a crucial decision. In this article, we’ll help you make it. So without extra preamble, here is our advice on the best and worst places to stake ATOM in 2022.

The 8 Best Places

1. Keplr

Keplr is the #1 recommended wallet for the Cosmos ecosystem. It will give you the greatest access to the widest variety of projects and, importantly, will allow you to claim all airdrops.

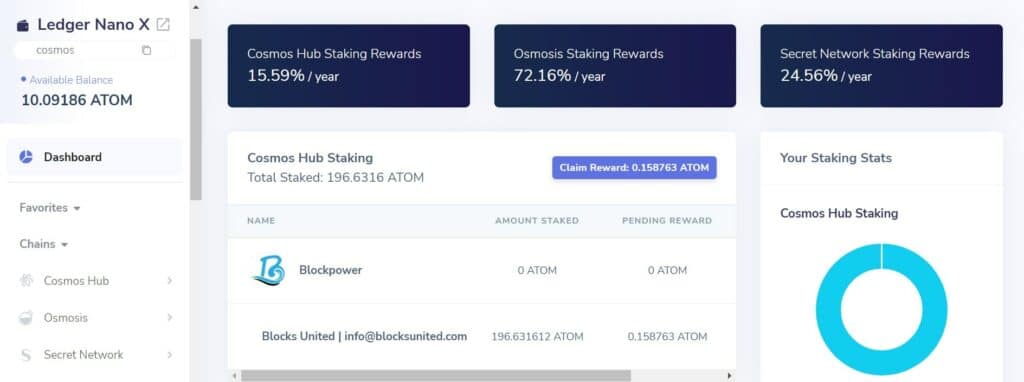

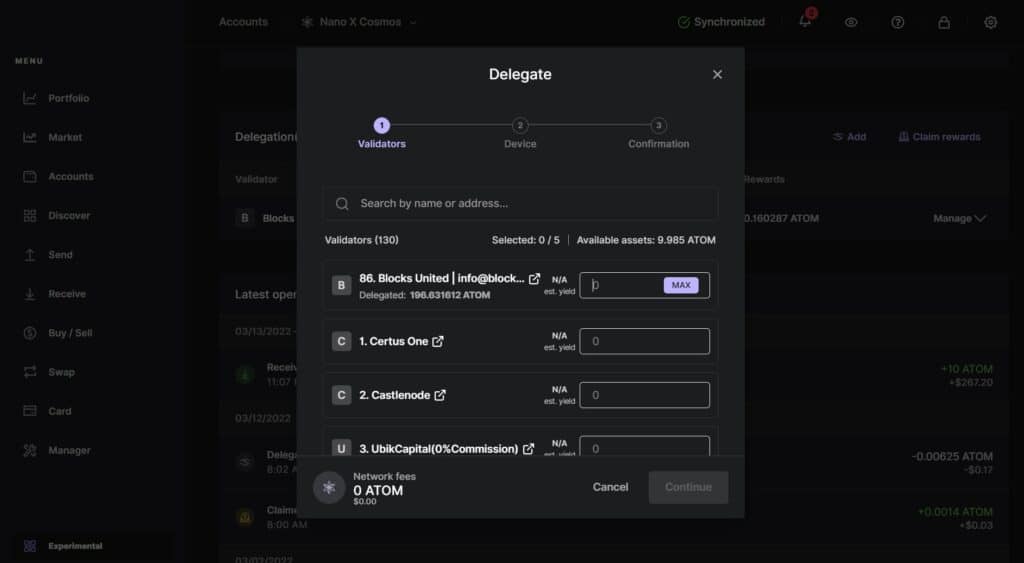

The wallet’s main dashboard page shows you the staking yield for all your assets. See the image below.

Staking is done in-wallet and couldn’t be easier. You’ll see yield, pending rewards, tokens available, etc.

Download the Keplr extension and then STAKE YOUR ATOM tokens to start earning block rewards on your idle crypto.

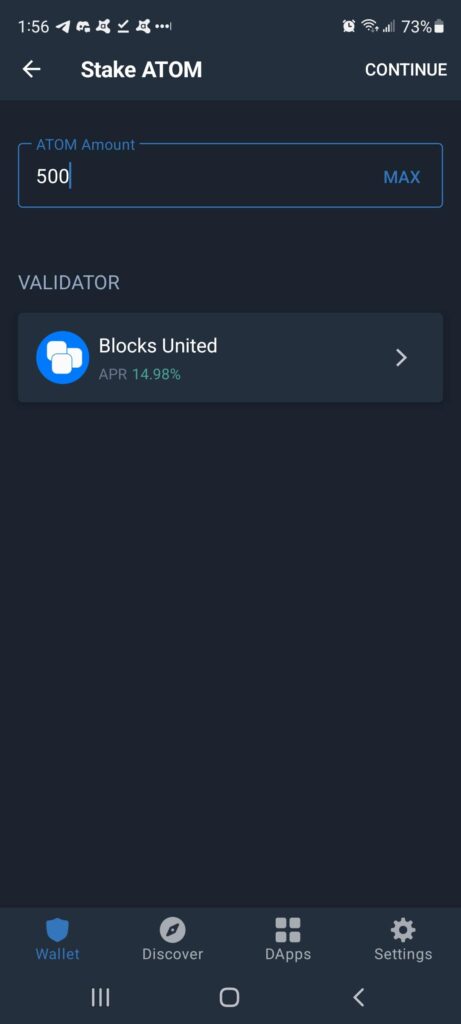

2. Cosmostation

Like Keplr, Cosmostation is a cosmos-native wallet. It will give you the 2nd best access to the Cosmos ecosystem and is loved by mobile users.

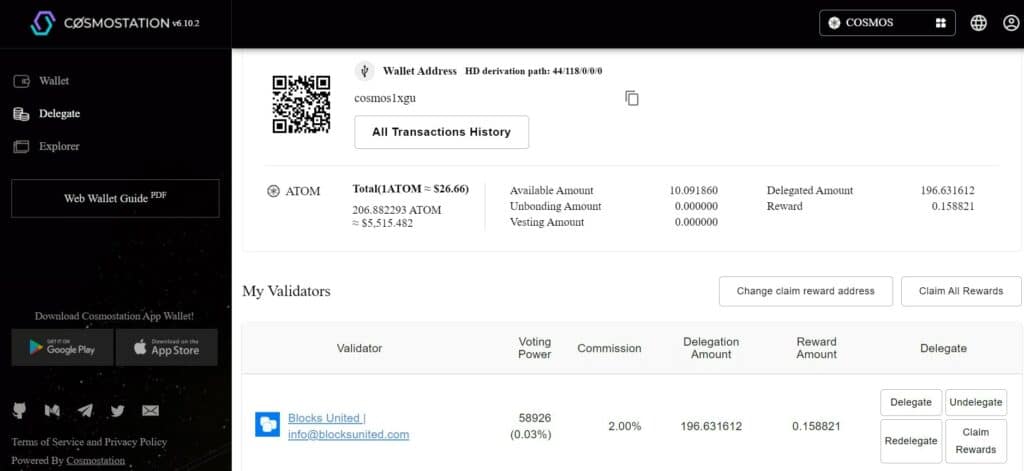

The wallet dashboard isn’t quite as user-friendly as Keplr, but still works great. ATOM staking is done in-wallet and you’ll see your delegated tokens right up top.

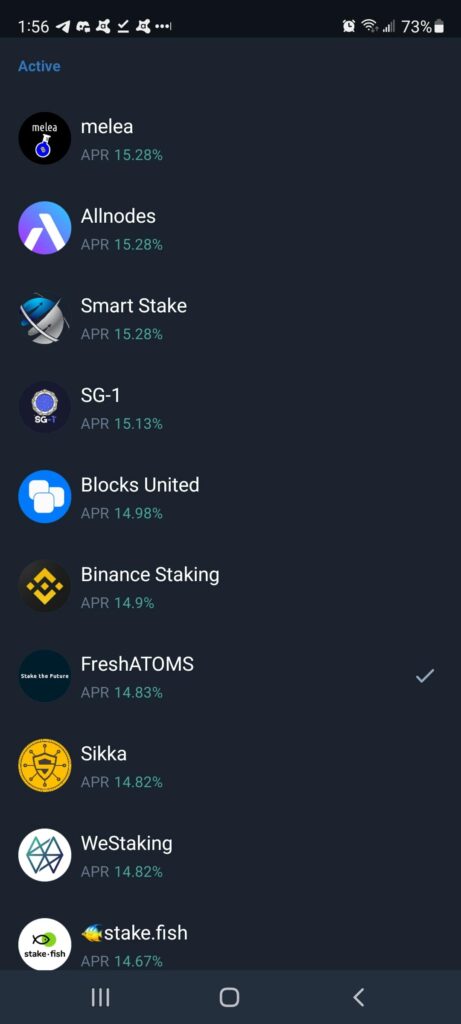

Like Keplr, you’ll have access to all 150 validators. See the image below.

3. Ledger Live

At Blocks United, we ALWAYS recommend using a hardware wallet. It will provide extra protection. You need to press the buttons on the physical device in your hand to approve transactions and move funds.

The Ledger Nano X is a great choice. The added protection will help you sleep at night. See image below.

ATOM staking can be done in-wallet, using the Ledger Live software that connects to your nano and you’ll have access to all 150 validators. However, the wallet software sometimes has connection issues and doesn’t sync properly with the Cosmos blockchain.

So, it’s recommended to connect your Nano to Keplr. You’ll then use the Keplr user interface to manage your Cosmos ecosystem tokens, but will still have to press the buttons on the physical Nano in your hand to approve transactions.

The Ledger Nano S is strictly for desktop users. The Ledger Nano X has Bluetooth capabilities and can link to your phone for mobile users.

Remember, not every wallet supports every token. You’ll have to connect your Nano to Keplr to claim your airdrops.

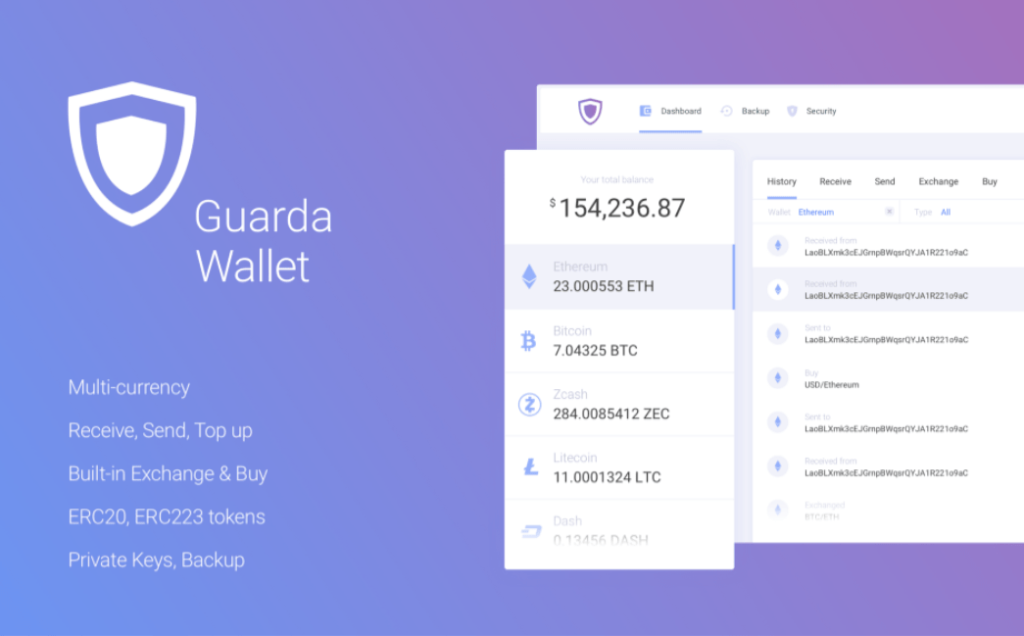

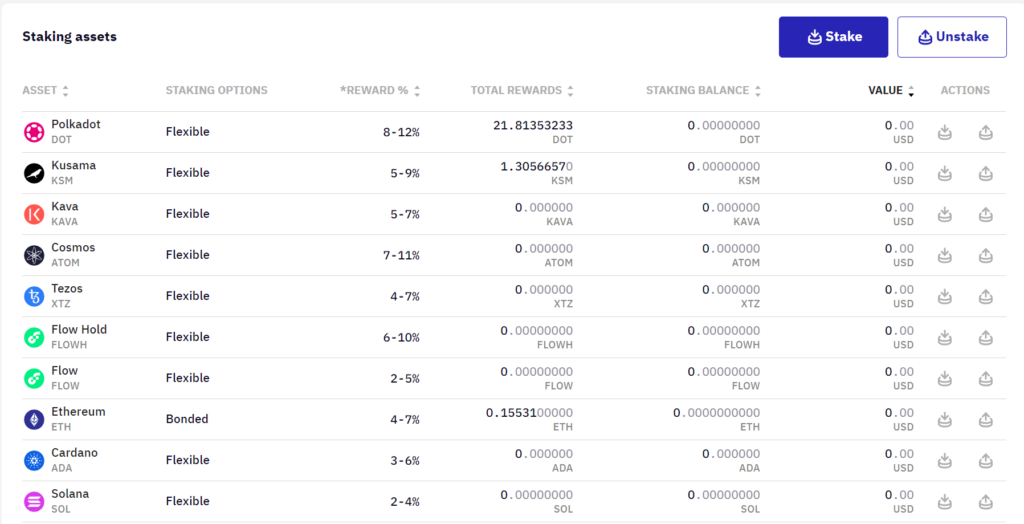

4. Guarda Wallet

Guarda is a great option because you can use it as a mobile app, web wallet, or connect your Ledger Nano. Using your connected Ledger Nano only gives you access to a few tokens (Not ATOM) and that’s why we’ve ranked it #4.

The in-wallet exchange is a great feature. Tons of tokens and multiple chains are supported. You can swap Bitcoin into other tokens right in-wallet.

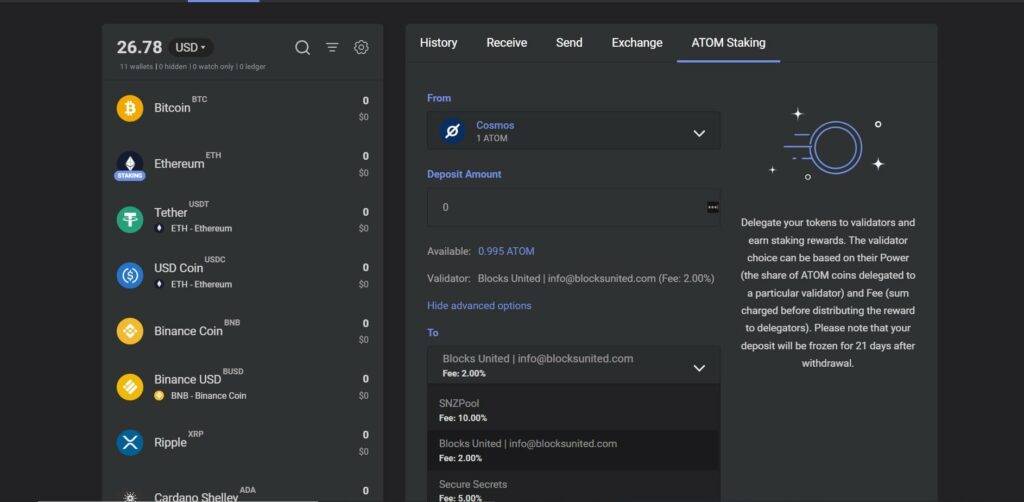

You can also stake your ATOM in-wallet, but what we don’t like is that the Everstake node appears to be the only staking option.

You’ll have to click “advanced options” to gain access to all 150 Cosmos validators. See image above.

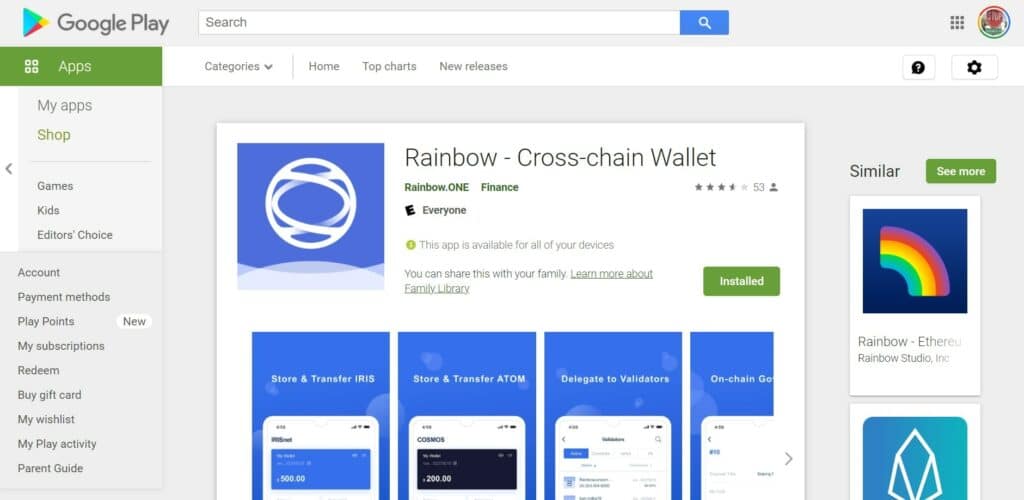

5. Rainbow Wallet

Rainbow Wallet is for mobile users and allows cross-chain transfers, token exchanges and staking. The wallet doesn’t have many options, so it’s best for those who like to keep things simple.

Rainbow Wallet does give you access to all 150 ATOM validators though, and that’s why it’s our #5 pick. Additionally, you’ll have to import your Rainbow Wallet seed phrase into Keplr to claim your airdrops.

6. Trust Wallet

Coming in at our #6 pick is Trust Wallet, which is owned by Binance. The wallet is mobile only, which is a bummer for desktop users because it’s so easy to use.

Plus, wallet connect allows you to connect your Trust Wallet to most web3 compatible websites. This allows users to stake tokens that aren’t available for in-wallet staking.

The 2 things we don’t like about Trust Wallet are the lack of access to all 150 Cosmos validators, and the inability to claim airdrops.

You’ll see that our Blocks United node is available as a staking option in Trust Wallet. But, we had to pay 1000 TWT tokens to be listed, so there are only 40 or so validators to choose from.

If you stake your ATOM tokens in Trust Wallet and want to claim your airdrops, you’ll have to import your seed phrase into Keplr. We have a tutorial that shows you how to do that.

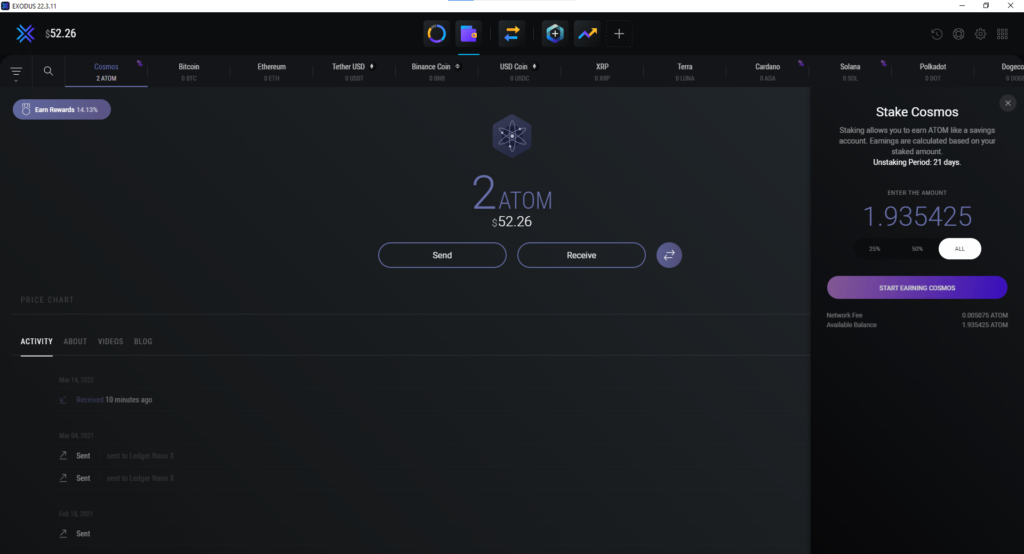

7. Exodus Wallet

Exodus is hands down the most beautiful wallet out there. It’s intelligently designed and easy for beginners to use. Plus, they have desktop and mobile versions.

The in-wallet exchange feature is cross-chain and offers plenty of options.

And you can type notes into each transaction, to label where funds came from or went to. For example: “Sent to Coinbase” could be a note you type into the wallet’s ledger.

Now for the bad news. Exodus only uses the Everstake validator node. That’s a bad thing for several reasons. Everstake is the 12th largest node as of this writing and huge nodes are terrible for network security.

- They’re the obvious targets for DDoS attacks. That’s when a hacker floods the nodes with hundreds of thousands of spam transactions in an effort to knock the node offline and disable the network.

- And, huge nodes can potentially deceive to profit by double signing blocks. Meaning, they say funds went one place when they actually went another. Once those transactions are immutably made into a block on the chain, it’s not easy to fix.

Staking your ATOM using Exodus wallet might disqualify you from receiving airdrops too, because the largest nodes are often excluded. Additionally, you’ll have to import your seed phrase into Keplr to claim them.

We’ve also written a comprehensive guide to staking with Exodus that you can follow.

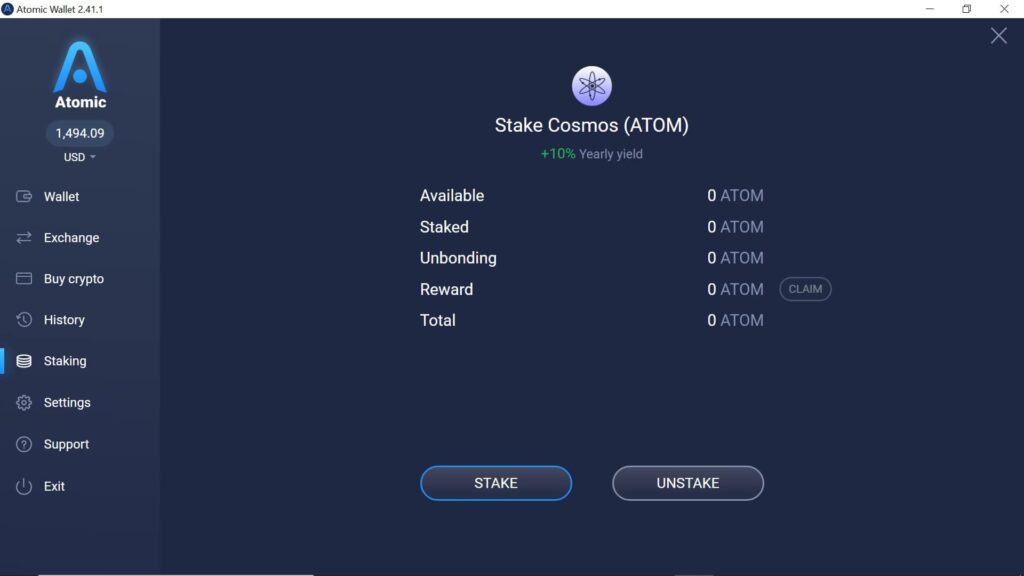

8. Atomic Wallet

Atomic Wallet has both desktop and mobile versions and a decent in-wallet token exchange, but is our least favorite wallet for staking ATOM tokens.

The wallet is easy to use, but they run their own validator node. Like Exodus, you only get one option.

Atomic wallet is user-friendly and you can stake in just a click or two, but the fact that you can’t choose your validators is a major drawback.

Lots of people like to stake with multiple validators to hedge their risk of downtime slashing. If that’s you, avoid Atomic Wallet.

Plus, they charge a hefty commission. As of this writing, the staking yield on our Blocks United node is 15.5%. Scroll up to see the image from Keplr wallet for proof. You’ll see in the image above that staking with Atomic Wallet cuts your rewards by a third!

Additionally, the wallet won’t allow you to claim airdrops. You’ll have to import your seed phrase into Keplr to claim airdrops.

Now, the places to absolutely avoid are centralized exchanges. In general, CEXs charge hefty commission, have huge validator nodes, prevent you from voting on network proposals AND prevent you from receiving airdrops.

The 4 Worst Places

If you are looking to build wealth, avoid the worst places to stake ATOM tokens.

In an nutshell, avoid staking with centralized exchanges for so many reasons. Remember FTX? I bet those people who lost their money will never let them sit on a centralized exchange again.

1. Binance.us

The worst place to stake your ATOM is Binance.us.

In 2022 Binance.us ATOM staking APY was only 1.5% to 3%. As of August 16, 2023 the ATOM staking APY at Binance has risen to an astounding 16.9%, but sure to change at any moment.

Wouldn’t you rather have a relatively steady 18% staking with Blocks United using a noncustodial wallet, like Keplr?

Binance has the sixth largest Cosmos validator node. Huge validators are terrible for network security. And, they never vote on network proposals. Scroll to the bottom of the Binance validator page on mintscan to see for yourself.

Plus, they have missed several Cosmos Hub chain upgrades and gone offline and have halted withdrawals on multiple occasions.

Additionally, Binance is under constant scrutiny by the U.S. Securities and Exchange Commission.

Remember, that those who stake with centralized exchanges are excluded from receiving airdrops. Airdrops incentivize people to stake with smaller validators to encourage decentralization, which strengthens the network.

Binance.us flat out sucks. The only reason to use Binance.us is to buy the handful of tokens that you can’t get on Kraken or Coinbase. Then, immediately withdraw them to a noncustodial wallet that holds your keys.

2. Coinbase

It’s important to point out that we are big fans of Coinbase for fighting the SEC and government overreach. Coinbase has doe a lot for crypto, but that doesn’t mean you should stake your tokens there.

The 2nd worst place to stake your ATOM tokens is Coinbase. Like Binance, they constantly adjust their staking reward rates to lure people in. As of August 16, 2023 Coinbase pays 10.5% to stake ATOM.

Staking with a noncustodial validator, like Blocks United currently yields 18%. Would you rather get 18.% staking from a noncustodial wallet, like Keplr or 10.5% at Coinbase? Duh!

The Coinbase validator is the largest Cosmos node and as mentioned previously, huge nodes are TERRIBLE for network security.

Plus, they don’t vote on network proposals. Check out their voting record at the bottom of their page on mintscan.

If you want what’s best for the ecosystem and thus the value of your ATOM tokens, DO NOT STAKE AT COINBASE. Check out this Reddit post by a Coinbase staker who couldn’t get his ATOM back.

Plus, those who stake with exchanges are prevented from voting on network proposals and from receiving airdrops.

Want to be notified when there are Cosmos ecosystem airdrops to claim? Sign up for our Cosmos Airdrops newsletter. As a bonus, you'll receive our wealth building series sent straight to your inbox!

3. Kraken

Kraken is a decent exchange, but ranks as our 3rd worst place to stake you ATOM. If you just want to keep it simple and stake all in one place, it’s a good option, but their commission is high and their validator node is huge.

As of August 16, 2023 The Kraken ATOM validator node is the 13th largest. Huge nodes are TERRIBLE for network security.

And like the other centralized exchanges, Kraken does not participate in governance.

Would you rather get 18% staking your ATOM with a noncustodial validator, like Blocks United, or 7%-11% at Kraken? That’s around 50% commission for those who don’t want to do the math.

Additionally, those who stake at Kraken are specifically excluded from receiving airdrops and voting on network proposals.

Check out our ATOM staking tutorial to see just how simple it is.

4. Binance.com

Rounding out our “worst places to stake ATOM tokens” list is Binance.com. United States residents don’t have to worry about this one, because they can only access Binance.us.

As a centralized exchange, Binance.com is by far the best. They have the widest variety of tokens and options to earn yield on them.

BUT, it’s still a centralized exchange. Remember, if you stake at Binance you’ll lose the ability to vote on network proposals and be specifically excluded from receiving airdrops.

Binance.com offers attractive yields, but lock your tokens up for 30, 60, or 90 days. When your staking term is up, it’s a competition to lock your tokens up for the most attractive term. Sometimes staking isn’t available because all the spots have been filled and you’re forced to just have your tokens sit idle.

Plus, The Binance ATOM validator is the 6th largest so please, do not stake wiht Binance. Huge validators are TERRIBLE for network security.

Now you should know the Best and Worst Places to Stake ATOM Tokens.

Fortunately, there are lots of options and as time passes more options will likely open up. But for now, the best place to stake your ATOM is with Keplr and the 2nd best place is with Cosmostation. If you’d like to see both those wallets in action, check out our ATOM staking tutorial.

Frequently Asked Questions

Like the saying goes, “Not your keys, not your coins.” There is always the risk that the exchange goes out of business and if that happens, you will likely lose your funds.

Never forget FTX, Celsius, BlockFi, Voyager, etc. These “reputable” centralized providers all went belly-up and stole customer funds.

It can be intimidating taking custody of your crypto, but it’s simpler than you think.

Check out our article: How To Self-Custody Your Crypto.

You better believe it! Exchanges have some of the highest commissions you will ever see. You pay for the convenience, but they don’t disclose their commission rate. They simply state the staking APY.

Centralized exchange commissions range anywhere from 10% up to 60%!

If the exchange is hacked you may lose your funds. We would like to think that they employ the best and brightest coders, but at the end of the day governments, like North Korea are trying to hack the exchanges. So are the sharpest hackers and global mafia groups.

The centralized exchanges are under constant threat of attack. Small, individual investors who self-custody their funds are not typical targets.

Public blockchains are meant to be decentralized. Check out our article: Why Is Decentralization Important for more detail.

In a nutshell, huge validators can collude, or get hacked to steal funds and destroy a blockchain. If you care about the value of your tokens, you should care about decentralization.

When you stake from a noncustodial wallet, like a Ledger, you are in control of your funds. If you are staking with validators outside the top 50 largest, then you are directly contributing to the network’s security!

For those who are new to crypto, staking with an American exchange is a simple option. While Coinbase and Kraken are not insured, they are regulated and Coinbase is publicly held, so it’s subjected to rigorous auditing.

Coinbase has done a ton for crypto. They hire the lobbyists who fight the SEC and government overreach. So, we are huge fans of Coinbase for leading the charge.

Staking with an exchange is super convenient and there are no lockup periods, like there are with traditional staking. If you stake your funds with Kraken today and need them back an hour later, it won’t likely be a problem.

However, they generally charge huge undisclosed commissions and the risks are nonzero. We fully advocate self-custody of funds for those who are comfortable with it.

Nothing we say is financial advice or a recommendation to buy or sell anything. Cryptocurrency is a highly speculative asset class. Staking crypto tokens carries additional risks, including but not limited to smart-contract exploitation, poor validator performance or slashing, token price volatility, loss or theft, lockup periods, and illiquidity. Past performance is not indicative of future results. Never invest more than you can afford to lose. Additionally, the information contained in our articles, social media posts, emails, and on our website is not intended as, and shall not be understood or construed as financial advice. We are not attorneys, accountants, or financial advisors, nor are we holding ourselves out to be. The information contained in our articles, social media posts, emails, and on our website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in our articles, social media posts, emails, and the resources on our website are accurate and provide valuable information. Regardless of anything to the contrary, nothing available in our articles, social media posts, website, or emails should be understood as a recommendation to buy or sell anything and make any investment or financial decisions without consulting with a financial professional to address your particular situation. Blocks United expressly recommends that you seek advice from a professional. Neither Blocks United nor any of its employees or owners shall be held liable or responsible for any errors or omissions in our articles, in our social media posts, in our emails, or on our website, or for any damage or financial losses you may suffer. The decisions you make belong to you and you only, so always Do Your Own Research.