This is article 7/11 in Part II of our series, How To Build Wealth and Grow Crypto Assets and Income by Staking.

Click the PREVIOUS ARTICLE button below to read the fifth article.

Key Takeaways

- Kava provides a transparent, decentralized, and permissionless solution for managing digital assets.

- The KAVA token is used for staking, securing the network, governance, and can be lent to the platform.

- Kava enables cross-chain swaps, lending, borrowing, minting and staking assets.

- Kava is secure and easy to use.

- Kava is continually expanding its offerings on the platform and as an ecosystem for dApp developers.

It is essential to have access to innovative platforms that enable secure, efficient, and profitable financial management. Kava is at the forefront of DeFi, helping to transform the financial services industry.

Unfortunately, it is no longer available to U.S. residents.

What is Kava.io?

There’s the Kava blockchain and a cross-chain DeFi platform built within the Cosmos network of zones. Kava offers a range of financial services that include borrowing, lending, and earning interest on your cryptocurrency investments.

Built on the highly secure and scalable Kava blockchain, it provides a transparent, decentralized, and permissionless solution for managing digital assets.

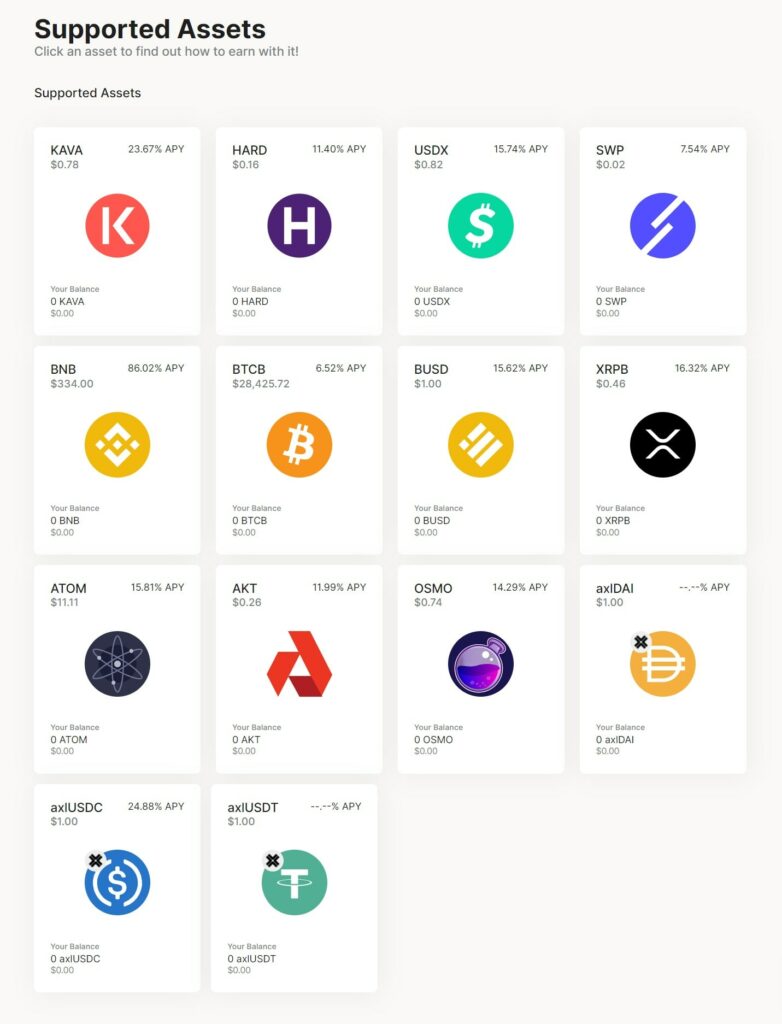

The platform supports BTCB, ATOM, XRP, BNB, USDT and many more.

The KAVA token is used for staking, securing the network, governance, and can be lent to the Kava platform.

KAVA's potential for long-term wealth building

Kava’s ability to connect various blockchain ecosystems gives the protocol a competitive edge. The platform is well-positioned to capitalize on the increasing adoption of DeFi solutions.

With a rich ecosystem and a user-friendly interface, Kava promises to empower users by providing all the necessary tools for a seamless experience.

The platform offers an ever-expanding suite of financial products, which increases the overall demand for its native token.

The Kava App: Your Gateway to DeFi

The Kava app (available at app.kava.io) is the user interface designed to help you access and manage your DeFi funds. With a clean and intuitive layout, the app allows you to perform various functions, including:

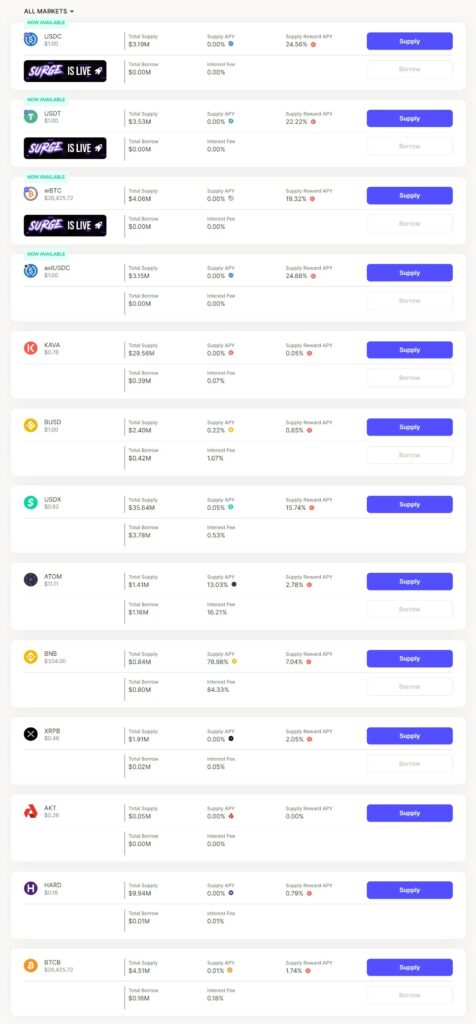

Lending: Earn passive income by lending your cryptocurrencies to other users. Kava’s secure lending platform offers attractive interest rates, making it a great option for investors looking to diversify their income streams.

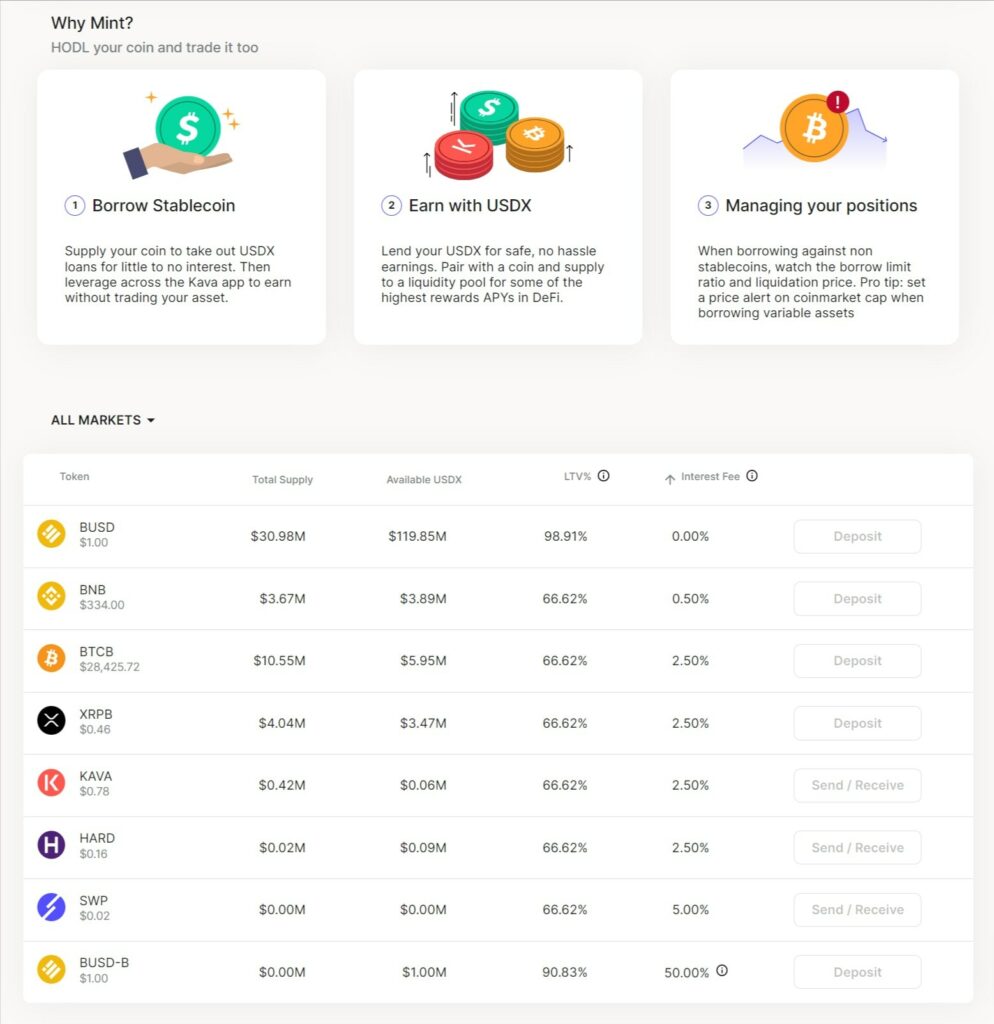

Borrowing: Use your digital assets as collateral to borrow stablecoins, like USDX. This feature helps investors who want to leverage their existing crypto holdings without selling their assets and incurring taxes.

Alongside many other stablecoins, USDX lost it’s $1 peg during the bear market. Always consider the risks before investing.

Swap: Seamlessly exchange supported assets using Kava’s built-in swap functionality. The platform connects to various liquidity sources, ensuring that users receive the best prices on the market.

Assets are continually added to the platform.

Staking: Staking your KAVA tokens helps secure the network and provides a steady passive income that you can compound to grow your wealth.

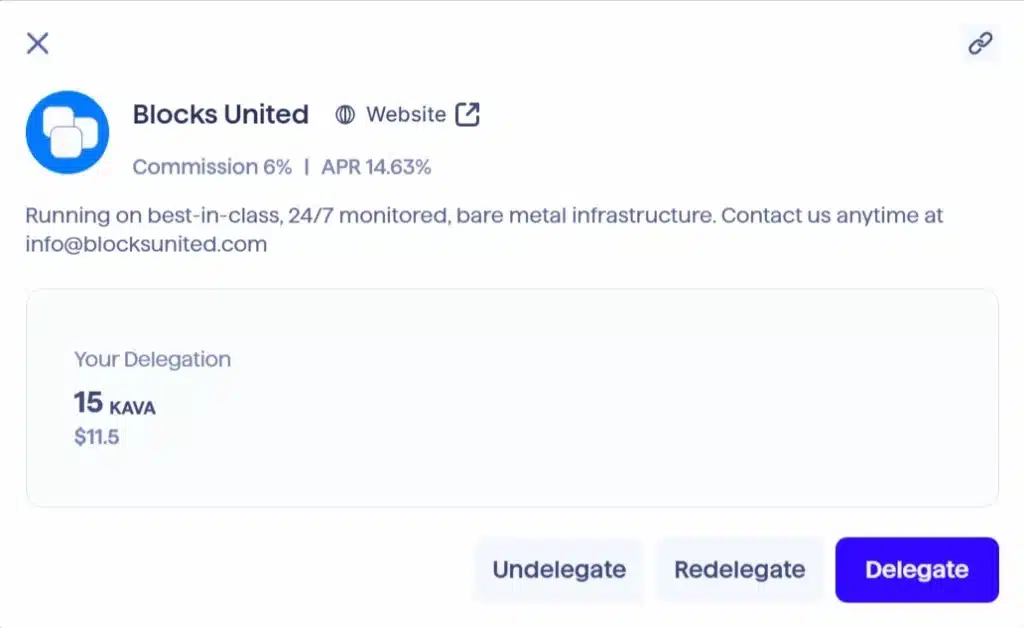

Stake KAVA with Blocks United using Keplr, Cosmostation, or Trust Wallet.

Or, stake KAVA on the platform to receive liquid bKAVA.

Why Choose Kava?

1. Interoperability: Kava’s cross-chain capabilities make it a highly versatile platform. You can seamlessly interact with multiple blockchain networks. This interoperability enhances the user experience and promotes collaboration within the broader DeFi ecosystem.

2. Security: Kava’s blockchain provides security and reliability. According to the official docs, “Developers can use Tendermint for BFT state machine replication of applications written in whatever programming language and development environment is right for them. Tendermint is designed to be easy-to-use, simple-to-understand, highly performant, and useful for a wide variety of distributed applications.”

3. Ease of Use: The Kava app’s user-friendly interface ensures that both beginners and experienced users can navigate and manage their DeFi investments with ease.

4. Ecosystem: Kava boasts a rich ecosystem of partners, developers, and projects, which drives innovation and ensures that the platform remains at the forefront of DeFi technology. There are currently 125 dApps and growing.

5. Governance: Kava’s decentralized nature empowers its users. By holding KAVA tokens, you can propose and vote on changes to the ecosystem, ensuring that the platform remains adaptive and responsive to the needs of its community.

6. Ongoing Development: Kava’s commitment to continuous improvement ensures that the platform remains up-to-date with the latest advancements in DeFi technology. You can expect on-going addition of new features and supported assets, keeping the platform competitive.

Maximizing Your Profits with Kava

Kava offers various ways to generate income and grow your wealth.

1. Yield Farming: Yield farming is a popular way to earn passive income. By providing liquidity to Kava’s supported pools, you can earn rewards in the form of KAVA, HARD, and the native tokens you supply. This dual reward system can significantly increase the returns on your investments.

Spending just a few minutes on the platform can help you identify the pools that offer the best combination of high yields and manageable risks.

2. Lending and Borrowing Arbitrage: Arbitrage is a strategy that involves exploiting price differences between markets or platforms.

Users attempt to capitalize on the interest rate differences between various DeFi platforms. You can borrow funds at a lower rate on one platform and lend them on Kava for a higher return, profiting from the rate difference.

To successfully execute this strategy, you must actively monitor interest rates across multiple DeFi platforms and identify opportunities with significant rate disparities. This process will be automated in the future.

3. Leveraged Trading: Leveraged trading is a high-risk, high-reward strategy using borrowed funds to amplify your exposure. With the Kava app, you can use various cryptos as collateral to borrow stablecoins, like USDX. You could then supply the USDX to the platform to generate yield, or swap into other trading positions.

However, leveraged trading also carries higher risk. If your collateral’s value drops below a certain threshold, your position may be liquidated.

So, it is crucial to understand the risks associated with leveraged trading and assess your risk tolerance before engaging in this strategy.

4. Token Price Appreciation: Kava is growing, adding new features and assets. As the platform expands and gains more adoption, the value of KAVA tokens may increase, providing potential for long-term capital gains.

5. Staking KAVA for Passive Income: Staking is a process that involves locking up your tokens to support the security and functionality of a blockchain network.

You can stake your KAVA tokens to help secure the network. In return for your stake, you will receive additional KAVA tokens, or liquid KAVA tokens (bKAVA) as staking rewards.

Reinvesting and compounding your staking rewards can help grow your passive income over time.

Staking KAVA also allows you to have a say by voting on network proposals. If you are too busy for that, don’t stress. We vote for our delegators, so you don’t have to.

How to begin staking KAVA tokens

Staking KAVA is done directly within your wallet. Please see our detailed KAVA staking tutorial, with video that will walk you through the process from beginning to end.

If you are comfortable taking a little more risk, consider liquid staking your KAVA.

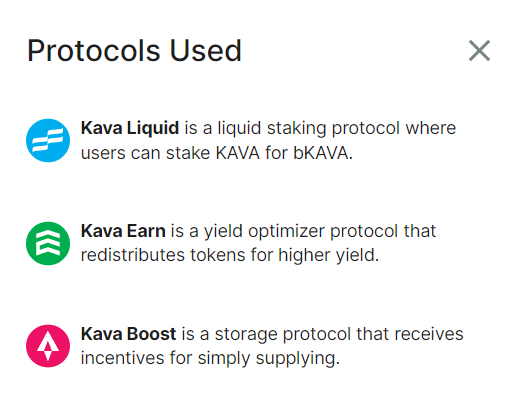

KAVA Liquid staking is done on the Kava platform. Supply KAVA and convert it to liquid staked KAVA (bKAVA). Traditional staking locks your tokens up for 21 days. Liquid staking has no lockup period. Liquid derivative tokens do have extra risk though.

You can boost yield by supplying bKAVA to Kava Earn (Yield Optimizer).

By employing these strategies, you can generate additional yield on your assets. Keep in mind that all investments come with inherent risks, and it is essential to thoroughly research and understand each strategy before committing your funds.

Conclusion

With its powerful suite of financial services, Kava offers a comprehensive solution for managing your crypto investments. By prioritizing security, flexibility, user experience, and commitment to development, Kava is well-positioned to become a leading platform in decentralized finance.

The platform is a top choice for both novice and experienced investors. Don’t hesitate – explore the power of Kava today!

Be on the lookout for our next article: Building Wealth by Staking MATIC Tokens: A Smart Investment in the Future.

Frequently Asked Questions

Kava Lend is for borrowing the various supported assets on the platform, including USDX. You can borrow 50% of what you deposit (LTV).

Kava Mint allows you to deposit supported assets and receive the USDX stable coin in return. You “mint” USDX. This allows you to HODL your crypto, but use it as collateral to earn yield. Minting allows you to borrow between 66%-99% LTV.

Both carry the risk of liquidation if the value of your collateral declines.

KAVA staking yield is currently around 15%, but it fluctuates. Inflation is much higher than 15%, which is one reason for the recent price decline. The protocol is issuing tokens to attract developers and users. Once the network matures, inflation should decline considerably, along with the staking yield.

The time to accumulate tokens quickly is when networks are young, because of the high inflation.

If you believe in Kava like we do and are holding your tokens for the medium to long-term, staking makes sense.

Beefy Finance is considered to be one of the best DEXs integrated with the Kava blockchain. There are currently 17 native DEXs that live on Kava. Elk Finance is a favorite of many.

You only need a single KAVA token to start staking and earning rewards.

KAVA tokens can be traded for fiat currency at centralized exchanges, Coinbase, Binance, Kraken, KuCoin, MEXC and many others.

The extra risk for liquid bKAVA would be smart contract exploit, low liquidity when you need to sell, and bKAVA de-pegging from KAVA.

Nothing we say is financial advice or a recommendation to buy or sell anything. Cryptocurrency is a highly speculative asset class. Staking crypto tokens carries additional risks, including but not limited to smart-contract exploitation, poor validator performance or slashing, token price volatility, loss or theft, lockup periods, and illiquidity. Past performance is not indicative of future results. Never invest more than you can afford to lose. Additionally, the information contained in our articles, social media posts, emails, and on our website is not intended as, and shall not be understood or construed as financial advice. We are not attorneys, accountants, or financial advisors, nor are we holding ourselves out to be. The information contained in our articles, social media posts, emails, and on our website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in our articles, social media posts, emails, and the resources on our website are accurate and provide valuable information. Regardless of anything to the contrary, nothing available in our articles, social media posts, website, or emails should be understood as a recommendation to buy or sell anything and make any investment or financial decisions without consulting with a financial professional to address your particular situation. Blocks United expressly recommends that you seek advice from a professional. Neither Blocks United nor any of its employees or owners shall be held liable or responsible for any errors or omissions in our articles, in our social media posts, in our emails, or on our website, or for any damage or financial losses you may suffer. The decisions you make belong to you and you only, so always Do Your Own Research.